When you fill a prescription for a brand-name drug, you expect to have the option to save money by switching to a generic version. In most states, pharmacists are legally allowed to swap the brand for a bioequivalent generic - unless the drugmaker makes sure that option disappears. This isn’t a glitch in the system. It’s a deliberate strategy. Companies are using legal loopholes, regulatory manipulation, and product changes to block generic competition, keeping prices high and consumers paying more. These aren’t just business tactics - they’re antitrust violations.

How Product Hopping Kills Generic Competition

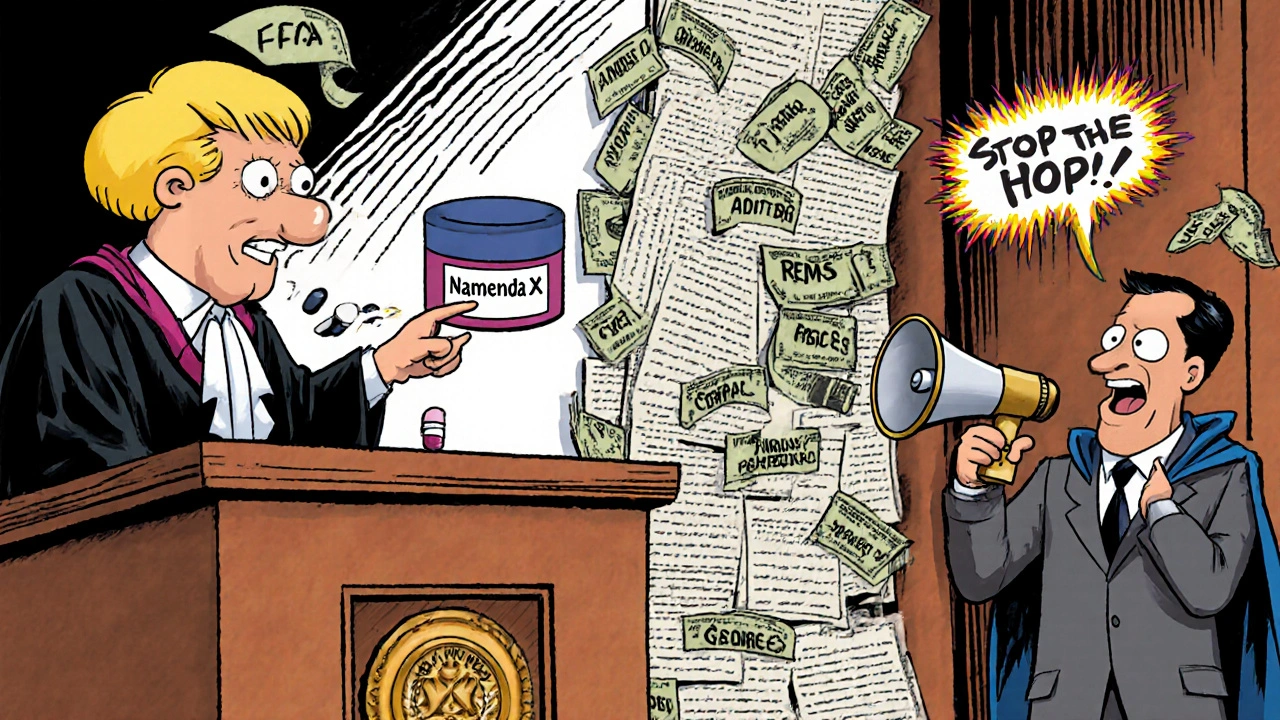

The core tactic is called product hopping. It works like this: a brand-name drug’s patent is about to expire. Generic manufacturers are ready to launch cheaper versions. Instead of letting the market work, the company pulls the original drug off the shelves and replaces it with a slightly modified version - maybe a new pill shape, an extended-release formula, or a different delivery method. Then they push doctors and patients to switch. Take Namenda, a drug for Alzheimer’s. In 2013, Actavis introduced Namenda XR, an extended-release version. Thirty days before the original Namenda IR could be legally substituted with generics, they pulled it from the market. The result? Patients couldn’t switch back. Pharmacists couldn’t substitute. Generics were locked out. The Second Circuit Court of Appeals called this “exclusionary conduct” because it destroyed the only cost-efficient path generics had to compete. It’s not just Namenda. Teva switched Copaxone from a daily injection to a less frequent one. Reckitt Benckiser replaced Suboxone tablets with films, then spread claims that the tablets were unsafe - even though the FDA never issued such warnings. These aren’t medical improvements. They’re legal traps.Why State Substitution Laws Don’t Work Anymore

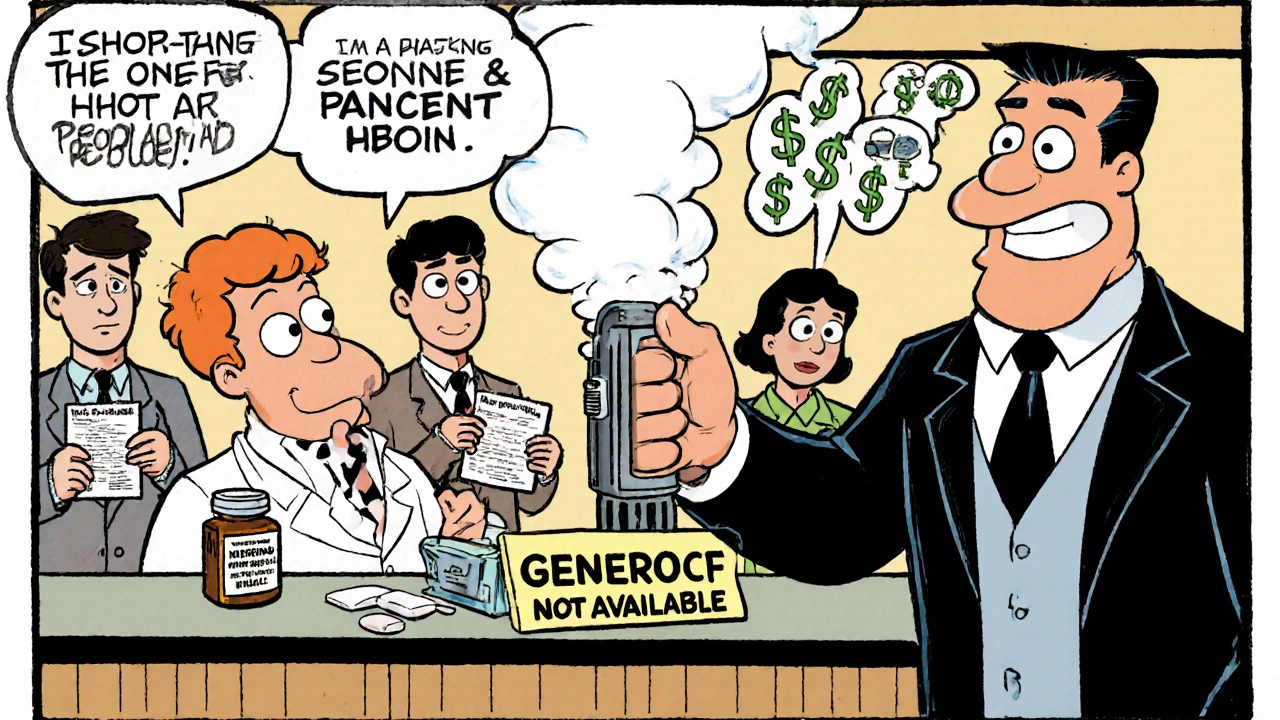

Most states have laws that let pharmacists automatically substitute generics unless the doctor says “dispense as written.” These laws were designed to save money. But when the original drug vanishes, those laws become useless. You can’t substitute a drug that’s no longer available. The FTC’s 2022 report found that when product hopping succeeds, generic market share drops from 80-90% to as low as 10-20%. That’s billions in lost savings. In the Ovcon case, a manufacturer introduced a chewable version and stopped selling the original. The generic version never got off the ground. Patients had no choice. Pharmacies had no product to swap. Even worse, some companies abuse FDA-mandated safety programs called REMS. These were meant to control dangerous drugs, but now they’re used to block generic access. Brand companies refuse to sell samples of their drugs to generic makers - samples needed to prove bioequivalence. Over 100 generic companies have reported being denied access. One study estimated this alone costs the system more than $5 billion a year.Court Battles: When Judges See the Scheme

Not all courts have seen through the trick. In 2009, a court dismissed a case against AstraZeneca for switching from Prilosec to Nexium - because Prilosec was still on the market. But in 2016, the Second Circuit ruled differently in the Namenda case. Why? Because the original drug was gone. No choice. No substitution. That’s the line. The Suboxone case went further. The court found Reckitt Benckiser didn’t just introduce a new product - they actively pushed patients away from the old one by spreading misleading safety claims. The FTC called it coercion. In 2019 and 2020, the company paid settlements to stop the practice. The difference? If the original drug stays available, courts often say adding a new version is “procompetitive.” If it’s pulled, courts start calling it anticompetitive. That’s the legal turning point.

Who’s Fighting Back?

The FTC has been pushing hard. After the Namenda ruling, they got a court order forcing Actavis to keep selling the original drug for 30 days after generic entry. That’s not a suggestion - it’s a legal requirement. State attorneys general are also stepping in. New York sued Actavis in 2014 and won an injunction blocking the withdrawal of Namenda IR. Other states have followed suit. The Department of Justice has gone after generic manufacturers too - not for blocking competition, but for colluding to raise prices. In 2023, Teva paid $225 million for leading a price-fixing cartel. Glenmark paid $30 million. That’s the flip side: when companies try to rig the system from both ends, regulators respond.The Real Cost: Billions Lost

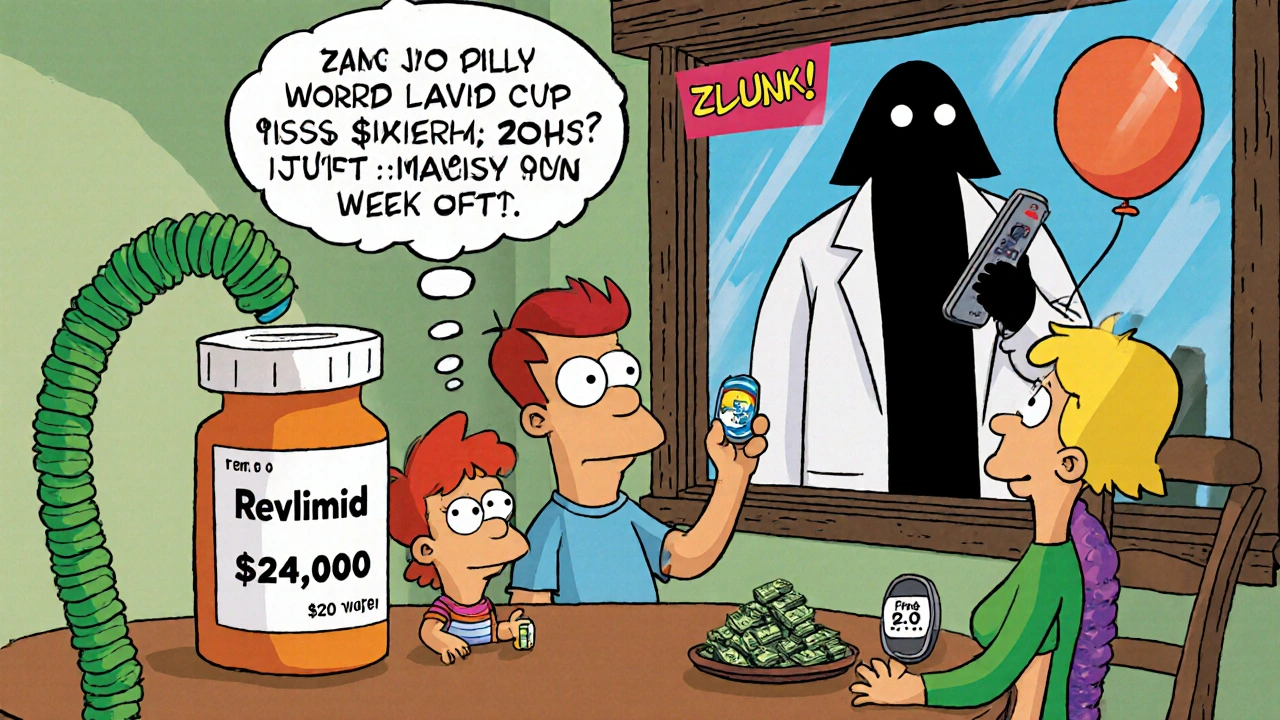

This isn’t abstract. It’s money out of your pocket. Revlimid’s price jumped from $6,000 to $24,000 per month over 20 years. Humira, Keytruda, and Revlimid together cost U.S. payers an extra $167 billion compared to Europe - because generics arrived years later here. That’s not innovation. That’s delay. The FTC estimates that delayed generic entry due to product hopping and patent thickets costs consumers and taxpayers billions every year. In some cases, a single drug can cost the system over $1 billion in unnecessary spending. Patients don’t just pay more. They get stuck with drugs that may be less convenient, more expensive, and no more effective. A patient switching from a daily tablet to a twice-daily film isn’t getting better care - they’re getting locked into a branded product.

What’s Next?

The FTC’s 2022 report was a wake-up call. Chair Lina Khan made it clear: product hopping is a top enforcement priority. Congress is paying attention too. In 2023, the House Committee on Appropriations directed the FTC to strengthen its efforts. Legal scholars are pushing for clearer rules. Right now, the law is a patchwork. Some courts block product hopping. Others let it slide. That uncertainty lets companies keep trying. Legislators are now looking at bills to:- Require brand companies to sell samples to generic makers under fair terms

- Define product hopping as an antitrust violation if the original drug is withdrawn before generic entry

- Prevent REMS abuse by limiting access restrictions to drugs with proven safety risks

What You Can Do

You won’t fix this alone - but you can be part of the pressure. Ask your pharmacist: “Is there a generic version available?” If they say no, ask why. If the answer is “the brand pulled it,” report it. Contact your state attorney general or the FTC. Consumer complaints help build cases. If you’re on a long-term medication, check if your drug is on the FTC’s list of product-hopping targets. Many are. If your prescription suddenly switches without your consent, ask your doctor: “Was this change medically necessary, or just a financial one?” The system was built to save money. It’s still possible - but only if we push back.What is product hopping in pharmaceuticals?

Product hopping is when a drug company withdraws an older version of a medication just before its patent expires and replaces it with a slightly modified version - like a new pill shape, extended-release formula, or different delivery method. The goal is to make generic substitutes impossible, since pharmacists can’t swap a drug that’s no longer on the market. This delays cheaper generics and keeps prices high.

How does the FTC fight product hopping?

The FTC fights product hopping by filing lawsuits and seeking court orders to force companies to keep selling the original drug until generics can enter. In the Namenda case, they won a court order requiring Actavis to keep selling the original version for 30 days after generic entry. The FTC also files complaints with state legislatures to strengthen substitution laws and investigates companies that abuse FDA safety programs to block generic access.

Can pharmacists still substitute generics if the brand drug is pulled?

No. State substitution laws only work if the original brand drug is still available. If the manufacturer pulls it from the market, pharmacists have nothing to substitute. That’s why product hopping works - it removes the foundation that makes generic substitution possible.

Why do courts sometimes allow product hopping and sometimes block it?

Courts look at whether the original drug remains available. If it does - like when AstraZeneca kept selling Prilosec after launching Nexium - courts often say adding a new version is competition. But if the original is pulled - like with Namenda IR - courts rule it’s anticompetitive because it eliminates the only path generics have to reach patients.

What role do REMS programs play in blocking generics?

REMS programs are supposed to manage drug safety risks. But some brand companies use them to refuse selling samples to generic manufacturers. Without those samples, generics can’t prove their drugs are bioequivalent - so they can’t get FDA approval. Over 100 generic companies have reported being denied access, and studies estimate this delays competition by billions in annual costs.

How much money do these practices cost consumers?

The FTC and independent analysts estimate that delayed generic entry due to product hopping, patent thickets, and REMS abuse costs U.S. consumers and taxpayers billions every year. For just three drugs - Humira, Keytruda, and Revlimid - the U.S. spent an extra $167 billion compared to Europe, where generics arrived sooner. Revlimid’s price rose over 300% over 20 years.

Comments (8)

Daniel Rod

28 Nov, 2025Man, this hits hard. I’ve been on a generic for years, and when my pharmacy switched me without warning, I thought it was just bureaucracy. Turns out, someone deliberately made sure I couldn’t go back. 😔

It’s not just about money-it’s about trust. We’re supposed to trust the system to have our backs, not to be rigged by corporate loopholes. When did healthcare become a game of chess where patients are pawns?

And why do we act surprised when the same companies that sell us drugs also control the rules? We need to stop treating this like an isolated scandal and start treating it like the systemic theft it is.

gina rodriguez

30 Nov, 2025This is so important to talk about. I’m a nurse, and I see patients struggle every day with these switches. They don’t understand why their meds changed, and they’re too scared to ask. Thank you for laying this out so clearly.

Maybe we need a simple handout for pharmacies-like a ‘Why Your Drug Changed’ flyer. Small things can help.

Sue Barnes

1 Dec, 2025Wow. Just… wow. So Big Pharma is literally manufacturing fake scarcity to keep you broke? That’s not capitalism-that’s organized crime with a lab coat.

And you people act like this is normal? Wake up. This isn’t ‘business strategy.’ It’s theft dressed up as innovation. If you’re not furious, you’re not paying attention.

jobin joshua

1 Dec, 2025Bro, I’m from India and we get generics like candy here. Like, $2 for a month of blood pressure meds. But here? Same pill, $300. 😭

Why is America so broken? Is it because you all love paying extra? 🤔

Sachin Agnihotri

1 Dec, 2025Okay, I’ve read this three times now… and I’m still stunned. I didn’t realize that pulling a drug off the shelf was actually illegal under antitrust law-if you can prove intent. And the REMS abuse? That’s just… criminal. I mean, if you’re not allowed to get a sample to test, how are generics supposed to exist? It’s like locking the door and saying, ‘No one can come in, even though the key is in the lock.’

Also, I just checked my prescription-Revlimid. Yep. That’s one of them. I’m calling my doctor tomorrow. And the FTC. And my rep. This ends now.

Diana Askew

3 Dec, 2025THIS IS A DEEP STATE PLOT. The FDA, the FTC, the pharma giants-they’re all in cahoots. You think they want you healthy? No. They want you dependent. That’s why they let generics in… but only after they’ve squeezed every dime out of you. And now they’re switching your meds to keep you hooked. It’s all controlled by the Illuminati. Or maybe the Bilderberg Group. Either way… you’re being played. 😈

King Property

4 Dec, 2025You’re all missing the real issue. This isn’t about product hopping-it’s about lazy regulators and dumb consumers who don’t read the fine print. If you can’t tell the difference between IR and XR, you deserve to pay more.

And don’t get me started on the FTC-they’re a joke. They’ve been chasing ghosts since 2010. Real competition? That’s when a generic maker innovates, not when they whine about a pill being pulled.

Also, your ‘$167 billion’ number? That’s inflated. It’s based on European prices, which are controlled by socialist price caps. Try comparing apples to apples, not apples to government-enforced poverty.

Yash Hemrajani

4 Dec, 2025Oh wow, so the answer is to just… keep the old pill around for 90 days? That’s it? No fines? No jail? No breaking up companies?

Meanwhile, the same CEOs who pulled Namenda are now on the board of a ‘health equity’ nonprofit. 😂

Let me guess-the next step is a ‘patient education campaign’ where they tell you to ‘ask your pharmacist.’ Like that’s going to change anything.

Meanwhile, in India, generics are sold next to chai. In the US, we’re paying for the privilege of being fooled by lawyers with MDs.