Ever bought a generic pill and been shocked by the price-only to find your neighbor paid a third of what you did for the exact same medicine? It’s not a mistake. It’s not a scam. It’s just how the system works. Generic drugs are supposed to be cheap. They’re copies of brand-name pills, made after patents expire, and they’re supposed to drive prices down. But in the U.S., the same 30-day supply of generic atorvastatin can cost $12 in one state and $120 in another. Why? The answer isn’t about manufacturing. It’s about state-level pricing chaos.

How the Same Drug Costs Different Amounts in Neighboring States

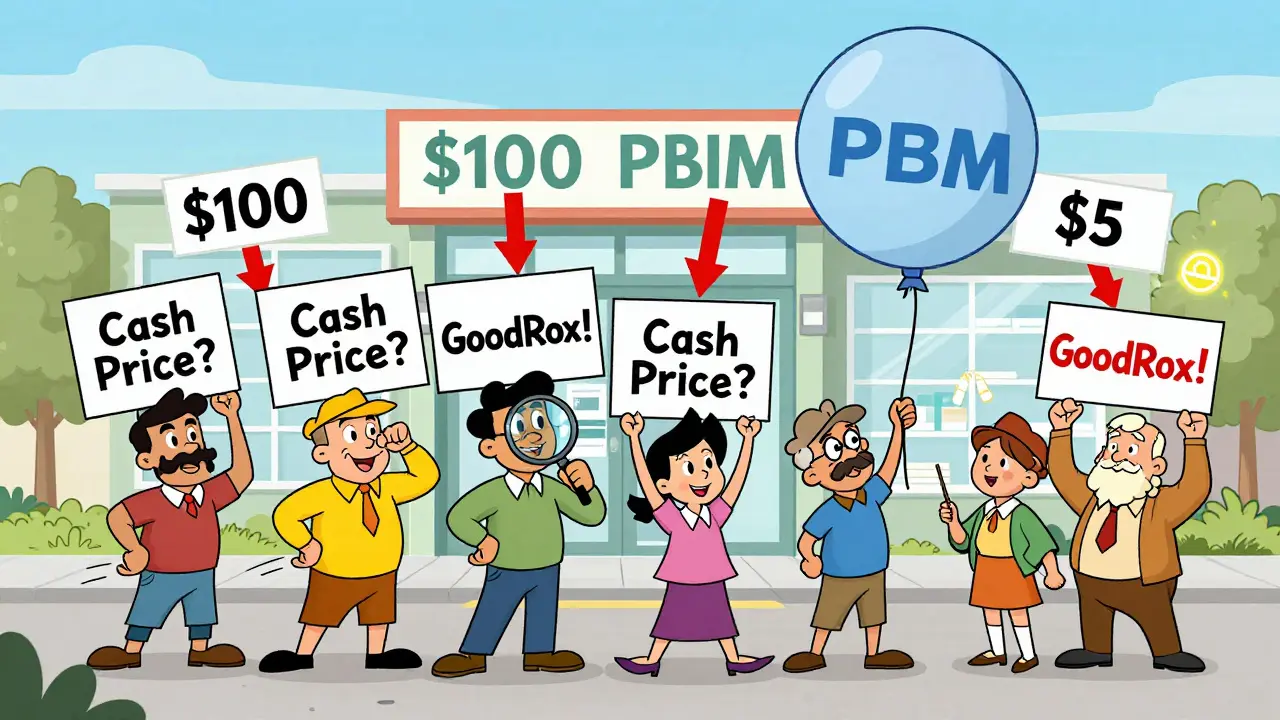

Think of a generic drug like salt. It’s the same chemical, made in the same factory, shipped in the same truck. But when it hits the pharmacy counter, the price doesn’t follow logic-it follows contracts, rules, and hidden middlemen. The biggest reason for price differences? Pharmacy Benefit Managers, or PBMs. These companies act as middlemen between drug manufacturers, insurers, and pharmacies. They negotiate prices, but they don’t always pass savings to you. In fact, they often keep the difference. In states like California and Vermont, laws force PBMs to disclose how they set prices. That transparency means pharmacies can’t hide markups. In Texas, Florida, or Ohio? No such rules. A PBM might tell a pharmacy to charge $100 for a pill, but only pay the pharmacy $15. The rest? That’s their profit. You never see the breakdown. And since insurance plans often use these secret PBM rates to calculate your copay, you’re stuck paying inflated prices-even if the drug costs less than $5 to make.Medicaid and Insurance Rules Make It Worse

Each state runs its own Medicaid program. That means each state sets its own reimbursement rates for generic drugs. Some use the National Average Drug Acquisition Cost (NADAC), which updates monthly and reflects what pharmacies actually pay. Others use outdated benchmarks or allow PBMs to set their own numbers. In states that use NADAC, generic prices are usually lower. In states that don’t? Prices stay high because there’s no real check on what pharmacies can charge. Even your private insurance plays a role. If your plan uses a PBM that’s tied to a big pharmacy chain (like CVS or Walgreens), you’re often forced into paying higher prices-even if the same drug is cheaper down the street. Why? Because your insurer has a deal with that chain. You can’t shop around. You’re locked in.Cash Beats Insurance-For Generics

Here’s the twist: if you pay cash, you often pay way less than with insurance. In 2022, GoodRx found that 97% of cash purchases for generics were cheaper than using insurance. Why? Because insurance companies rely on PBM pricing, which is inflated. Cash buyers bypass that system entirely. Services like GoodRx, Blink Health, or Mark Cuban’s Cost Plus Drug Company show you the real price-no middleman, no hidden fees. A 2021 study showed that retail generic prices averaged 66% of the original brand-name drug’s cost. But the actual cost to the pharmacy? Often under 20%. That means if you pay cash, you’re getting close to the true cost. If you use insurance? You’re paying the inflated, PBM-approved rate. In states with high PBM concentration-like New York or Illinois-this gap is wider. In states with more independent pharmacies, like Montana or Maine, cash prices are often even lower.

State Laws Tried to Fix This. Most Failed.

In 2017, Maryland passed a law making it illegal for PBMs to charge more than a certain markup on generic drugs. It was bold. It was direct. And within a year, a federal court struck it down. Why? Because the court said states can’t regulate interstate commerce. PBMs operate across state lines. So, Maryland’s law was seen as interfering with business outside its borders. Other states tried too. Nevada targeted diabetes drug prices. California required price transparency. But without federal backing, these efforts were like patching a leaky boat with duct tape. Some laws survived. Others got tied up in lawsuits. The biggest takeaway? States can’t force drug prices down alone. But they can force companies to be honest about them.Why Rural Areas Pay More

If you live in a small town in Oklahoma or West Virginia, you’re not just paying more because of state rules-you’re paying more because there’s no competition. One pharmacy. One PBM contract. No alternatives. That’s it. In cities, you might have 10 pharmacies within a mile. That drives prices down. In rural areas? You’re stuck with whatever price they set. Plus, delivery costs are higher. Shipping a box of pills to a remote pharmacy costs more. That gets added to your bill. And fewer people means less volume. Less volume means less negotiating power. So even if the drug costs the same everywhere, your town ends up paying more just because you’re isolated.

What You Can Do Right Now

You don’t have to wait for laws to change. You can take control today.- Always check GoodRx or SingleCare before filling a prescription-even if you have insurance. Sometimes the cash price is lower than your copay.

- Ask your pharmacist: "What’s the cash price?" Don’t assume insurance is cheaper. It rarely is for generics.

- Switch to a mail-order pharmacy if your plan allows it. They often have better rates because they buy in bulk.

- If you’re on Medicare, use the $35 monthly cap on insulin. It’s real. And it applies in every state.

- For long-term meds, consider Cost Plus Drug Company. They list the exact cost of the drug plus a 15% markup. No secrets. No games.

Comments (14)

Chiraghuddin Qureshi

21 Jan, 2026Bro, I just paid $8 for my generic metformin in Delhi using a local pharmacy app 🤯 Same drug in NYC? $90. The system is rigged, but at least we know how to game it. India’s got nothing on this chaos 😅

Oren Prettyman

21 Jan, 2026It is, of course, an incontrovertible fact that the structural inefficiencies inherent in the American pharmaceutical supply chain are not merely a function of state-level regulatory variance, but rather a manifestation of the broader neoliberal commodification of healthcare as a market good rather than a human right. The PBM oligopoly, operating under the legal fiction of third-party intermediary status, effectively functions as a rent-extracting cartel that systematically externalizes cost onto the uninsured and underinsured alike, thereby perpetuating a regressive health equity deficit that is both morally indefensible and economically unsustainable.

Tatiana Bandurina

22 Jan, 2026You people act like this is new. I’ve been working in pharmacy billing for 18 years. The cash price is always lower. Always. And no, your insurance isn’t helping. They’re just making you pay more so they can say they’re 'covering' you. You’re not a patient. You’re a revenue stream.

Philip House

22 Jan, 2026The real issue isn’t the PBMs. It’s that we let corporations run everything. The government could cap prices tomorrow. But they won’t. Why? Because the same people who write the laws own the drug companies. You think this is about health? Nah. It’s about power. And you’re just a number on their spreadsheet.

Brenda King

22 Jan, 2026Always ask for the cash price first. Seriously. I used to think insurance was cheaper until I started checking GoodRx. Now I pay $4 for my blood pressure meds. My friend pays $80 with insurance. Same pharmacy. Same pill. It’s not magic. It’s just greed. And you don’t need to be a genius to beat it. Just be lazy enough to check the app.

Lana Kabulova

23 Jan, 2026Wait-so if I’m on Medicaid in Texas, I’m getting charged based on some outdated benchmark that doesn’t reflect what pharmacies actually pay? And if I’m in Vermont? I’m getting the real cost? So the difference between $12 and $120 isn’t manufacturing or shipping-it’s literally whether your state decided to be honest or not? That’s not a system. That’s a joke. And we’re laughing while we pay for it?

arun mehta

24 Jan, 2026In India, generic drugs are sold at cost-plus-5%. No middlemen. No PBM games. The government regulates prices strictly because healthcare is seen as a public good, not a profit center. I wish more Americans understood that capitalism without regulation doesn’t create efficiency-it creates exploitation. We can do better. We’ve done better elsewhere.

Patrick Roth

24 Jan, 2026You’re all missing the point. The real villain isn’t the PBM-it’s the FDA. They approve generics like they’re identical, but the bioequivalence standards are laughably loose. Some generics are 80% as effective. So yeah, price varies. Because sometimes you’re getting real medicine and sometimes you’re getting chalk with a label. Don’t blame the system. Blame the fact that we treat pills like toilet paper.

Liberty C

25 Jan, 2026Oh sweet summer child. You think this is about drugs? It’s about control. The entire healthcare system is designed to keep you dependent, confused, and docile. If you knew how much your pills really cost, you’d riot. And they know it. That’s why they bury the numbers under layers of jargon, insurance jargon, and PBM nonsense. You’re not being overcharged. You’re being manipulated. And you’re too busy scrolling to notice.

shivani acharya

25 Jan, 2026They’ve been doing this since the 90s. PBMs were created to 'save money'-now they’re the biggest drug profiteers. And guess who owns them? Big Pharma. Yep. The same companies that made the brand-name drugs now sell the generics through their own middlemen. You think you’re saving? You’re just paying the same guy with a different name tag. This isn’t capitalism. It’s a Ponzi scheme with aspirin.

Sarvesh CK

27 Jan, 2026There’s a deeper philosophical tension here: the individual’s right to affordable care versus the corporate imperative to maximize shareholder value. We’ve allowed the latter to dominate the former, not because it’s more efficient, but because it’s more profitable. The tragedy is not that prices vary-it’s that we’ve normalized this variation as inevitable. But if we can agree that medicine is not a luxury, then we must demand a system that reflects that truth-not one that hides behind legal loopholes and state-by-state patchwork.

Hilary Miller

27 Jan, 2026Cash price > insurance. Always. GoodRx saved me $200/month. Do it.

Malik Ronquillo

28 Jan, 2026Man I used to pay $110 for my generic Adderall. Then I found a pharmacy that sold it for $12 cash. I felt like I won the lottery. Why does anyone still use insurance for generics? It’s like paying extra to get your own wallet back.

Keith Helm

30 Jan, 2026The federal government must preempt state-level regulations and establish a national transparent pricing database for all pharmaceuticals, including generics, with mandatory real-time disclosure of acquisition cost, PBM markup, and final consumer price. This is not optional. It is a matter of public health integrity.