Every year, over 1,000 applications pour into the FDA to bring cheaper generic drugs to U.S. pharmacies. Without a reliable funding system, these reviews would stall for years. That’s where generic drug user fees come in - a quiet but powerful engine keeping the pipeline moving.

How GDUFA Keeps Generic Drugs Moving

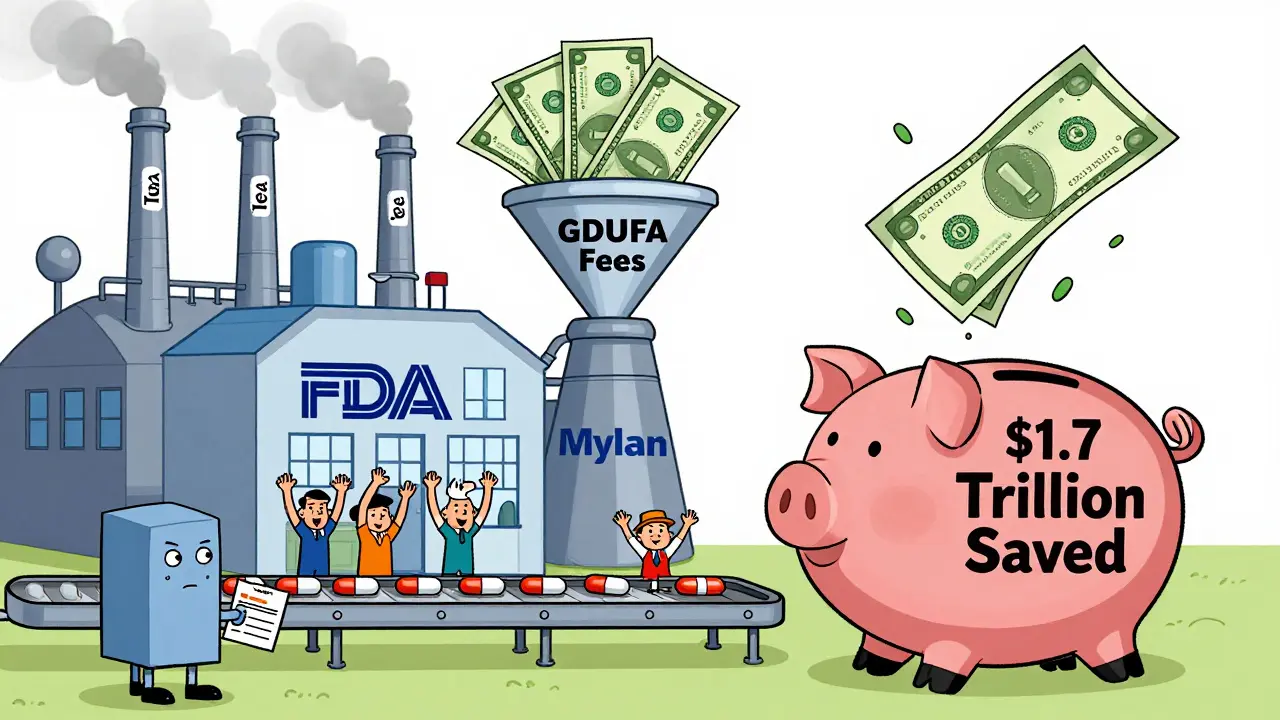

In 2012, Congress created the Generic Drug User Fee Amendments (GDUFA) to fix a broken system. Before GDUFA, generic drug applications took an average of 30 to 36 months just to get reviewed. Patients waited longer than necessary for affordable versions of brand-name drugs. The FDA was underfunded, understaffed, and drowning in paperwork. GDUFA changed that by letting generic drug makers pay fees to help fund the FDA’s review process. It’s not a tax - it’s a performance-based partnership. The FDA uses these fees to hire more reviewers, upgrade technology, and reduce backlogs. Today, about 75% of the Office of Generic Drugs’ budget comes from these user fees, not taxpayer dollars.The Four Types of Fees

There are four main fees under GDUFA III, which runs through 2027. Each targets a different part of the drug approval process.- Application fees: $124,680 per Abbreviated New Drug Application (ANDA). This is what manufacturers pay every time they submit a request to sell a generic version of a brand-name drug.

- Program fees: $385,400 per year for any company with an approved generic drug on the market. This covers the FDA’s ongoing oversight.

- Facility fees: $25,850 per manufacturing site that makes active ingredients or finished pills. If your company owns two plants, you pay twice.

- Drug Master File (DMF) fees: $25,850 when a company first submits a technical file detailing how they make an active ingredient. This helps the FDA review ingredients faster later.

These fees aren’t arbitrary. They’re set by Congress and reviewed every five years. The FDA publishes exact numbers annually. For example, in 2023, the application fee was $124,680 - less than 4% of what brand-name drug makers pay under PDUFA. But here’s the catch: while PDUFA handles about 70 new brand-name drugs a year, GDUFA handles over 1,100 generic applications. Volume matters.

Why the Fees Work - And Where They Fall Short

The results speak for themselves. Before GDUFA, it took over three years to approve a generic drug. Today, the FDA aims to complete 60% of reviews within 15 months. In 2021, they hit 52% - close, but not quite there. Pandemic delays and more complex applications pushed some targets back. Still, the improvement is massive. Median approval times dropped from 36 months to under 12 months, according to former FDA official Dr. Janet Woodcock.But GDUFA isn’t perfect. About 1,500 applications from before 2012 are still waiting. The FDA promised to clear those by September 2024 - and they’re on track. Another issue? Small manufacturers. A $25,850 facility fee might be a drop in the bucket for Teva or Mylan, but for a small company with one plant and five approved drugs, it’s 15% of their entire regulatory budget. The Generic Pharmaceutical Association says this hurts innovation. The FDA offers a 75% fee reduction for qualifying small businesses, but only 18 of them used it in 2022. Many don’t know they’re eligible.

Who Pays - And Who Benefits

The top 10 generic drug companies control 60% of the U.S. market. Teva leads with 17%. These big players pay the bulk of the fees. But the real winners are patients and the healthcare system. Generic drugs make up 90% of all prescriptions in the U.S. but only 23% of total drug spending. That’s because they cost 80-85% less than brand-name versions. Over the past decade, GDUFA has helped speed up generic entries after patents expire - saving consumers an estimated $1.7 trillion.Still, market problems remain. One in five generic drug markets have only one or two suppliers. That can lead to shortages or price spikes. The FDA’s 2023 Drug Competition Action Plan says GDUFA is key to fixing this. Faster reviews mean more companies can enter the market - more competition, lower prices.

How Manufacturers Navigate the System

Paying fees sounds simple. It’s not. Companies must use the FDA’s electronic system (EUF) to submit payments. Deadlines matter: program fees are due April 1, facility fees by October 1, and application fees when you submit. But here’s where it gets messy: affiliation rules. If two companies are owned by the same parent, or if one owns more than 50% of another, they’re considered linked. That affects who pays what. The FDA got 147 requests in 2022 from companies disputing their fee assessments - mostly around ownership confusion.Learning the system takes time. New regulatory staff often need 3 to 6 months to get comfortable. The FDA offers webinars, calculators, and a helpdesk - but many small firms don’t use them. Some just hire consultants. Others delay submissions to avoid fees. That’s a risk. Miss a deadline, and your application gets rejected before it’s even reviewed.

What’s Next for GDUFA

GDUFA III’s big new move is the DMF completeness assessment. Before, the FDA only reviewed active ingredient files after a full application was submitted. Now, companies can get feedback on their DMFs early. This cuts months off the approval timeline. The FDA is also pushing to eliminate all pre-GDUFA backlog by late 2024.Big questions are brewing for GDUFA IV (2027+). Should it cover over-the-counter (OTC) drugs? Right now, OTC monograph drugs - think antacids, cough syrups, and allergy meds - aren’t included. That’s a $117 billion market. A Congressional report estimates adding them could bring in $150-200 million more a year. Industry is divided. Some say it’s overdue. Others worry about added costs.

Another idea under discussion: using real-world data - like pharmacy sales or patient outcomes - to monitor generic drug safety after approval. That could reduce the need for repeat clinical trials. But manufacturers fear the cost and complexity.

Is GDUFA Worth It?

A 2022 Duke-Margolis study found GDUFA led to a 22% increase in generic drug approvals each year. Ninety-seven percent of first-review goals were met in 2021. A survey by Evaluate Pharma showed 68% of generic companies rated GDUFA’s impact as positive or very positive. Transparency improved too - 85% of respondents said communication from the FDA was clearer.Still, the system isn’t flawless. Fee affordability, backlog delays, and OTC exclusions are real problems. But the alternative - going back to 3-year review times - is unthinkable. Patients need affordable drugs now. GDUFA isn’t perfect, but it’s the best tool we have to get them there.

What are generic drug user fees?

Generic drug user fees are payments made by manufacturers of generic medications to the U.S. Food and Drug Administration (FDA) to help fund the review of their applications. These fees are authorized under the Generic Drug User Fee Amendments (GDUFA), which was first passed in 2012 and renewed in 2022. The money supports hiring staff, improving systems, and reducing approval times - not direct approval decisions.

Who pays the generic drug user fees?

The companies that make or sell generic drugs pay the fees. This includes manufacturers who submit Abbreviated New Drug Applications (ANDAs), own approved generic products, operate manufacturing facilities, or hold Drug Master Files (DMFs) for active ingredients. Even if a company doesn’t make the drug itself, if it’s referenced in an application, it may owe a fee.

How much do generic drug user fees cost?

In fiscal year 2023, the fees were: $124,680 per ANDA application, $385,400 per year for program fees, $25,850 per manufacturing facility, and $25,850 per Drug Master File (DMF). These amounts are adjusted annually and published by the FDA. Small businesses may qualify for a 75% reduction if they meet specific criteria.

Do user fees speed up generic drug approvals?

Yes. Before GDUFA, reviews took 30-36 months on average. Today, the FDA aims to complete 60% of original ANDA reviews within 15 months. In 2021, median approval times dropped to under 12 months. While the 60% target wasn’t fully met due to pandemic delays and complex applications, the timeline improvement is undeniable.

Are there any downsides to GDUFA?

Yes. Small manufacturers often struggle with the cost of facility fees, which can eat up a large portion of their regulatory budget. The system also doesn’t cover over-the-counter (OTC) drugs, leaving a $117 billion market unregulated under GDUFA. Additionally, about 1,500 legacy applications from before 2012 are still pending, and fee rules around corporate affiliations can be confusing and lead to disputes.

How does GDUFA affect drug prices?

By speeding up the approval of generic drugs, GDUFA increases competition in the market. More generics mean lower prices. The FTC estimates GDUFA has contributed to a 15% increase in timely generic entries after brand-name patents expire. Over the past decade, this has saved U.S. consumers an estimated $1.7 trillion in drug costs.

Comments (10)

Nancy Kou

20 Dec, 2025Let’s be real - without these fees, we’d still be waiting two years for a simple generic blood pressure med. The FDA isn’t some bureaucratic monster; they’re just trying to keep up with a system that’s been stretched thin for decades. This isn’t corporate greed - it’s infrastructure.

Kinnaird Lynsey

22 Dec, 2025Interesting how the same people who scream about ‘big pharma’ never mention that the fee structure actually forces transparency. The FDA publishes every number. You can track exactly how much each company pays. That’s more than you can say for most government programs.

Andrew Kelly

22 Dec, 2025Oh sure, let’s just let drug companies pay the FDA to approve their drugs. Next thing you know, the FDA’s gonna be on retainer for Big Pharma. This isn’t funding - it’s regulatory capture dressed up as ‘performance-based.’ And don’t even get me started on how the ‘small business’ discount is a joke. 18 companies used it? That’s because the paperwork to qualify is longer than the application itself.

Isabel Rábago

23 Dec, 2025People act like this is some noble public-private partnership, but let’s not pretend these fees aren’t passed on to patients. Every dollar a company pays goes into their pricing model. And don’t tell me ‘it’s only 4% of what brand-name companies pay’ - that’s like saying ‘it’s only $500 extra on your mortgage’ when you’re already drowning.

Glen Arreglo

24 Dec, 2025As someone who’s worked in regulatory compliance across three continents, I’ve seen this play out. The U.S. system is messy, but it’s the only one that actually moves. In Europe, generics take 4 years. Here? Under a year. That’s not magic - it’s money well spent. The real problem is the lack of public awareness. Nobody knows this exists, so nobody defends it.

Hussien SLeiman

25 Dec, 2025Let me break this down for you in case your corporate-funded brain can’t process it: The FDA doesn’t have a budget problem - it has a political problem. Congress refuses to fund it properly, so they let corporations fund their own regulators. That’s not efficiency - that’s surrender. And now we’re supposed to cheer because the wait time dropped from 36 months to 12? That’s still a year longer than it should be. Meanwhile, the same companies paying these fees are the ones hoarding patents, gaming exclusivity loopholes, and jacking up prices on life-saving meds. You’re not fixing the system - you’re just lubricating the machine that’s broken.

And don’t give me that ‘$1.7 trillion saved’ nonsense. That’s not savings - that’s the difference between what people *should* pay and what they’re *forced* to pay because there’s no real competition. One in five markets have one or two suppliers? That’s not a feature - that’s a failure. GDUFA didn’t fix that. It just made the delay look prettier.

And the DMF fee? That’s a tax on innovation. If you’re a small startup trying to develop a novel generic delivery system, you’re already out of pocket $25k before you even submit an application. Meanwhile, Teva’s legal team has a spreadsheet that automates their fee payments. This isn’t leveling the playing field - it’s cementing the oligopoly.

And let’s talk about the 1,500 legacy applications still sitting there. The FDA promised to clear them by 2024. They’re ‘on track.’ Right. Like a slow leak is ‘on track’ to empty the bathtub. That’s not progress - that’s neglect dressed in bureaucratic jargon.

And the OTC exclusion? That’s not oversight - that’s laziness. Antacids, cough syrup, allergy meds - these are daily drugs for millions. Why are they treated like second-class citizens? Because they’re not profitable enough for the big players to lobby for inclusion. So the FDA ignores them. Classic.

So yes, approval times are faster. But the system is still rigged. The real question isn’t whether GDUFA works - it’s whether we’re okay with a system where the only thing that matters is how fast you can pay your way through the door.

shivam seo

27 Dec, 2025Canada’s system doesn’t have these fees and we get generics in 6 months. Why? Because we don’t let corporations buy regulatory access. The FDA’s just a paid concierge for Big Pharma. This whole thing is a scam.

Moses Odumbe

27 Dec, 2025Bro, I work at a small generic lab. We paid $100k in fees last year. Got 3 applications approved. Took 9 months. The system’s not perfect, but it’s the only one that works. I’d rather pay than wait 3 years. 🤷♂️💸

Dev Sawner

29 Dec, 2025It is imperative to note that the structural inequities embedded within the GDUFA framework disproportionately impact micro-enterprises lacking institutional legal infrastructure. The administrative burden of fee categorization, coupled with the non-transparent interpretation of affiliation rules, constitutes a non-tariff barrier to market entry. Empirical data from the Indian pharmaceutical sector suggests that similar fee-based models in developing economies lead to market consolidation, not competition. Therefore, the assertion that GDUFA promotes competition is empirically unsound and ideologically biased.

benchidelle rivera

29 Dec, 2025It’s not about whether the fees are fair - it’s about whether the system works. And it does. We’re approving 1,100+ generics a year. Without this, we’d be stuck in the 90s. The real tragedy is that people who benefit the most - patients - don’t even know this exists. So they blame the wrong things. Let’s fix the awareness problem before we tear the whole thing down.